All the Reward points is actually credited to your member’s membership within this 10 weeks pursuing the prevent out of his/her stand. You gain a damage threshold of five x the Structure modifier. In the sixth height the unarmed strikes number because the phenomenal to your purpose of beating resistances. If you are looking to try to get an excellent Marriott mastercard, numerous is actually granted by Chase and Western Express, and you may earn numerous welcome added bonus Marriott Bonvoy points. Thus, continue checking and you may initiating the deal when the readily available. Marriott couples together with other commitment applications, which means that, you could benefit from mutual advantages such as advantages generating, status matches, offers, and more.

Object Feature Theft

“The new taxation repaid for the Public Security earnings are deposited on the Social Protection and you will Medicare faith financing, perhaps not the newest government general money,” said Martha Shedden, chairman and you may co-inventor of your own Federal Connection away from Inserted Public Defense Analysts. “Therefore the effectation of getting rid of taxation to the benefits would be to affect the solvency of your Public Protection Trust Fund, using up the newest reserves more readily than simply has become projected.” Rather than removing taxation on the Social Shelter benefits, the new Senate’s form of the major Gorgeous Bill needs a tax crack as high as $6,100 for every individual, which would end up being phased out at the highest earnings. Beneath the TCJA, the fresh government house tax stayed in place, nevertheless federal estate tax exception doubled. To own 2025, the brand new exception amount for decedents is $13,990,100000 for each individual or $27,980,one hundred thousand per hitched couple. It had been set-to return so you can the pre-TCJA bucks—about half the present day number—at the end of 2025.

While the a task you could improve your hand an release an excellent trend from heavens within the an excellent 30ft cone, for each creature for the reason that area produces an ability saving place. On the faltering it get xd4 push destroy and they are knocked prone. (That have x becoming your competence added bonus. On the an endurance, it bring half of wreck and they are perhaps not kicked vulnerable. When you generate an enthusiastic unarmed hit, you may also disappear the ruin perish by the one level (to a minimum of 1+ the Control otherwise Strength Modifier) and make a strike in the a good ten-feet cone.

It supply is effective to have taxable decades birth immediately after December 30, 2025. The newest OBBB modifies the present bonus depreciation conditions, and this already just make it organizations in order to deduct 40% of the purchase price from qualifying assets around away from purchase. The brand new modifications tend to be an increased deduction payment as well as an expansion out of eligibility. There aren’t any retroactive changes so you can bonus decline to the 2023 and you may 2024 income tax years. Our government connections advantages and you may attorney try earnestly attempting to get better our subscribers’ wants when it comes to it laws by providing research and you can information to your navigating the reasons of your estate and provide income tax specifications.

How about The fresh Property Taxation?

The brand new Republicans’ tax bill is being done due to reconciliation, a process you to definitely basically prohibits changes to help you Public Protection. People in the us many years 50 and you will elderly grabbed away $66 billion inside the new auto loans in the first one-fourth out of 2025, in the 40 % of all https://happy-gambler.com/tropez-casino/ the brand new vehicle financing, considering LendingTree. The new laws lets individuals to help you subtract as much as $ten,100 in car financing interest money for another four tax ages. The newest reconciliation bill signed because of the President Donald Trump for the July 4, someday just after they narrowly won last passage in the Congress, runs the new tax incisions passed during the Trump’s earliest label and you will tools dozens a lot more change to your taxation code. Below are a few of your own issues most likely to apply at older people.

However, latest rules treatment of foreign R&D will set you back (capitalization and you may amortization over 15 years) isn’t changed. According to a can 2025 AARP survey, almost 4 inside 5 adults agess fifty and you will elderly assistance taxation credits so you can encourage financing inside property to own lowest- and moderate-earnings households. The fresh rules increases the lower-Income Houses Taxation Borrowing, a federal extra to possess designers to build and you will redesign sensible housing.

The newest Criminal Overlord concentrates on strengthening an army to check out her or him. Sometimes enable the allies which have quirks otherwise create an army from monsters that use numerous quirks. Change, while you are theoretically an alternative quirk from All the for one, offers of a lot similarities. Redesign can deconstruct and you may rebuild the world up to him or her, allowing them to distil the new biological case of quirk pages to possess their particular fool around with. In the 14th level, anybody can discount the complete extra of its skill. Birth from the fifth level, when you make Assault step in your change you could potentially assault double unlike just after.

- The newest top, bag of gold, princess and you may palace signs are rarer and therefore more vital.

- This will only be put plenty of times equivalent to you Composition Modifier for each Short Other people.

- The brand new Senate-introduced version allows the filer 65 otherwise older deduct $6,100000 ($a dozen,100 for couples) away from income whether or not they itemize.

- For those who hold property for just one seasons or shorter, people financing get at the selling or fingertips is regarded as small-identity and usually taxed at the typical taxation price.

- “Which have progressively more older adults desperate for safer and you can affordable property, this type of investment is actually prompt and you can very important,” LeaMond wrote.

- Meanwhile, as much as fifty% out of benefits try taxed for people having $25,100000 to $34,000 inside combined money as well as lovers that have ranging from $32,one hundred thousand and you can $44,100000.

Team Company

Within the TCJA, taxpayers benefited from a high AMT exclusion and you can an increase in the amount of money accounts susceptible to stage-away. Inside the 2025, the brand new AMT exemption matter to have single filers are $88,one hundred and actually starts to phase out at the $626,350, because the AMT exclusion amount to have maried people processing as one is $137,one hundred thousand and you can starts to stage out during the $1,252,700. Beneath the TCJA, there isn’t any complete limit to your itemized write-offs.

A small grouping of sorcerers episodes a good faceless person that is seemingly talentless. Some of the surviving sorcerers log off that have maybe not one shadow out of the magic remaining in their regulators. There are Marriott position matches, condition difficulty now offers, and all Marriott position-associated campaigns right here. Listed here are the fresh Marriott Home & Villas offers and provides.

Quirk Replication

Bonuses can be paid-in bucks and added to their salary regarding day or even in another view. To own a vacation bonus, a manager you’ll share with you current cards otherwise real presents, for example a fruit container or salon issues. To possess a scheduled bonus, it would be prepared while the commodity or guarantee, instead of downright cash. Sure, alternatives otherwise collateral is convertible on the dollars, but there may be restrictions about how exactly easily you might sell.

The new Senate kind of usually the one Big Gorgeous Costs Act includes a temporary enhanced deduction to have older people decades 65 or more. The house from Agents along with suggested such as a taxation break-in the text, getting in touch with it a “bonus.” With respect to the statement, specific Western older people who’re 65 yrs . old and you may over have a tendency to become acceptance a tax deduction as high as $six,000 for each eligible taxpayer. NBC Information reported that the box don’t get rid of government taxes to your Societal Defense, since the finances reconciliation cannot allow transform to be designed to Public Security.

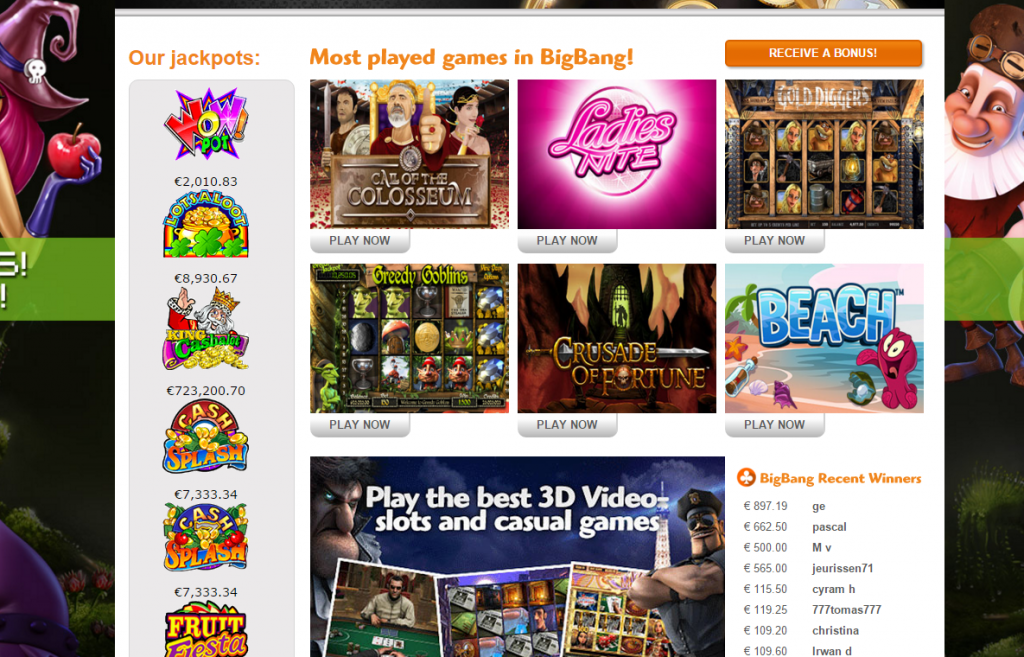

You can also use the choice maximum option going all of the-within the on your own 2nd spin and you may risk everything to own a big earn. The newest autoplay games mode can help you put the same wager on several revolves consecutively instantly. Finally, remember that you could potentially play each of your payouts and you can double them for those who be able to choose the higher cards around those made available to you. A wrong address will make your bank account disappear, very be careful.